Submit your invoice

Get your invoices paid early on the Priority Supplier Programme

Herefordshire Council is inviting you to become a member of its fast, fair and fuss-free early payment programme.

A unique way to get paid early

Herefordshire Council is offering accelerated payment with no factoring, no borrowing, no credit checks and no complicated processes.

Faster payment

Fast-tracked invoice processing and dedicated contacts for when you need to get in touch.

Fair and transparent pricing

No sign up or admin costs, just a small percentage fee deducted from each invoice based on how early you are paid.

Fuss-free sign up

Join in 2 minutes, with no extra set up required to get started. Just simple, straightforward, early payment.

How it works

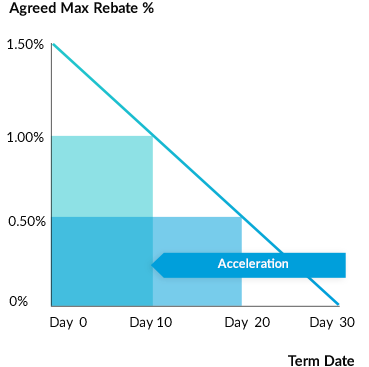

The Priority Supplier Programme enables your invoices to be paid ahead of contractual payment terms in exchange for a pre-agreed rebate. The rebate is applied dynamically as the invoice is paid and is proportionate to how many days your payment is accelerated by.

Wait for your invoice to be approved by the Council. This is targeted at day 10

Your invoice is paid as soon as it is approved with a small rebate deduction

You will receive a debit note to help balance your accounts

Your participation matters to us

The programme reflects the forward-thinking way that the Council wants to work with its suppliers, while also allowing them to reinvest in critical and under-funded services. Your participation is greatly appreciated.

“

Our suppliers benefit from improved cash flow and reduced time spent chasing payments.

”

A better way of doing business with Herefordshire Council

Healthier cash flow

Pre-approved access to cash with no borrowing, no credit checks and no personal guarantees to worry about

With funds in your account earlier, you're in control of your own money

Access to funds you can invest in other important areas of your business

Peace of mind

With reliable early payment, your monthly outgoings are covered

No more chasing late or lost invoices, losing valuable man hours within your business

Dedicated supplier support based in the Council available to help whenever you need

A better working relationship

With fewer queries on invoice payment, you've got more time to talk about the things that matter to your business

Become a recognised Priority Supplier Programme supplier, raising the profile of your business within the Council

Be on the side of your customer and become part of an important initiative that helps protect vital services for the local community

How early payment has helped other businesses

Don't just take our word for it. Hear what other businesses like you have said about the early payment programmes and how it has helped their businesses.

“

Being part of the programme has enabled us to focus on growth. We're investing more time into attracting new residents and staff rather than chasing invoices.

”

How do we compare to other financing options?

Priority Supplier Programme offers earlier payment in exchange for a small percentage fee taken off the invoice value, to cover the cost of the programme. To ensure it's fair, the percentage amount is tied to the number of days your payment is accelerated: no acceleration means no fee.

Early payment programme

None

No

Pre-approved

Sign up in two minutes

None

No debt, interest, risk of missed repayments or impact of your credit rating

Dynamic % fee taken from each invoice dependent on the number of days payment is accelerated

Invoice factoring

Monthly service fees

Early payment fees

Arrangement fees

Dependent on provider

Risk assessment based on range of factors including the volume and size of your invoices, payment terms, your company history and track record

If clients don't pay you may have to buy back invoices

Your reputation may suffer if the factoring company doesn't align to your company's values

Pre-agreed discount taken from each invoice - usually between 0.5% and 5% of the amount loaned

Plus service charges

Business loan

Late payment charges

Administration fee

Yes - pre-application

Missed payments can accrue and be noted on your credit history

Lenders will look at your credit rating and assess your business and personal tax returns, bank statements, financial statements and legal documents

Missed payment cost can incur fees and negatively impact your credit rating

Long-term loan could restrict the monthly cash

Interest rates vary but typically the APR is between 5% - 10%

Plus late payment fees

Business credit card

Late payment charges

Administration fee

Inactivity charges

Cash withdrawals

Yes - pre-application

Missed payments can accrue and be noted on your credit history

Lenders will look at your credit rating and other checks dependent on the size and financial strength of your business

Missed payments can incur fees and negatively impact your credit rating

Some businesses won't accept payments via card

Interest rates vary but typically the APR is in the range of 15% - 20%

Plus late payment fees

Here to help

Is the programme mandatory?

No, a core principle of the Priority Supplier Programme is that it is fair for everyone. This means it is a voluntary initiative that suppliers are invited to join.

Does it cost anything to join?

The programme is free to join. There are no service charges, admin fees or hidden charges. A small percentage fee is deducted from each invoice based on the number of days your payment has been accelerated.

How does the dynamic fee work?

To cover the cost of the programme, a small percentage fee is deducted from each invoice. This fee is called the Early Payment Rebate (EPR). The EPR is dynamic, which means the amount is dependent on the value of the invoice and number of days your payment is accelerated.

Is this invoice factoring?

No, the programme is not a form of factoring. Your invoices are not being sold to a third party, and all payments will continue to come directly from Herefordshire Council.

How will early payment impact the invoice submission process?

You will continue to submit your invoices electronically as normal, just to a new email address. You will be paid by Herefordshire Council when the payment is authorised instead of waiting for the payment due date.

How will I know what I've been charged?

The payment process is transparent and the relevant information (the percentage fee and the number of days your payment has been accelerated by) will be issued on a debit note alongside your payment.

Will my existing terms and conditions change?

The terms and conditions for the Priority Supplier Programme will only vary the payment terms applied to your contracts, but in all other respects, your contracts remain in full force and effect.

Who is Oxygen Finance?

Herefordshire Council has partnered with Oxygen Finance as the leading expert at providing payment process improvements to government procurement offices and to optimise its payment performance through consultancy, supplier engagement and technology.

Oxygen Finance have signed up over 16,000 suppliers to its clients' early payment programmes, with over £5.5bn worth of invoices receiving early payment